Beyond Detection: The Next Frontier in Flare Management

SCADA driven Root Cause Analysis Flaring events are among the most visible and closely scrutinized operational signals i…

SCADA driven Root Cause Analysis Flaring events are among the most visible and closely scrutinized operational signals i…

.png?resize=410x0)

Arolytics recently launched a code-based service that delivers an efficient, auditable, and scalable solution for UNEP O…

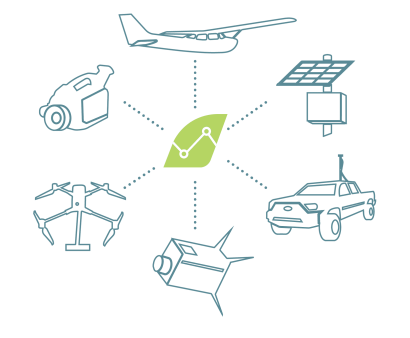

The oil and gas sector is under pressure to reduce methane emissions and find ways to improve operational efficency. Reg…

.png?resize=410x0)

Press Release: https://www.prnewswire.com/news-releases/arolytics-collaborates-with-st-francis-xavier-university-to-rele…

In oil and gas operations, Supervisory Control and Data Acquisition (SCADA) systems have long been the nerve center&mdas…

Thoughts on creating joint value for operations and sustainability. For years, our team at Arolytics has been meeting w…

The political landscape in North America is shifting. Will these changes diminish methane as a critical issue? In this p…

In an era where Canadian producers are looking for safe ways and spaces to share traceable and auditable methane data, i…

Arolytics is proud to announce an exciting new partnership with FluxLab at St. Francis Xavier University, led by Dr. Dav…

The largest energy importer in the world - the European Union - has recently approved a groundbreaking law that will set…

A group of Arolytics employees taking a stretching break! Arolytics Recognized as One of Canada's Best St…

Arolytics founding team, L-R: Emmaline Atherton, Dr. David Risk, Liz O’Connell Arolytics, an innov…

On June 30, 2023, the U.S. Environmental Protection Agency (EPA) proposed several amendments to the Greenhouse Gas Repor…

July 18, 2023, Calgary, AB - Arolytics is thrilled to announce its acceptance into the Chevron Technology Ventures (CTV)…

If you are working for an oil and gas producer in Canada in a role involving ESG or regulatory compliance, you may have…

Advancing the Mission to Reduce Energy Sector Emissions February 17, 2023, Calgary, AB - Arolytics receives 375k in fun…

Award Winners at the 2022 RICE Energy Tech Venture Forum. HOUSTON – (September 20, 2022) – Out…

1 – CEM 2022

Date: March 2-4, 2022

Host: ILM Exhibitions

Location: Virtual Event

Description:…

Arolytics is thrilled to announce our latest solution, AROviz Field. Are you struggling to connect teams, activities, a…

Arolytics is honoured to be named a Top 10 Innovator in Sustainability by Darcy Partners! Thank you Darcy Partners for r…

On Thursday December 16 at 2 pm MST the #PandellLeadershipSeries “Move to Measurement: Emissions Leadership in 20…

Arolytics co-founders, Emmy Atherton and Liz O'Connell have been named to the 2022 Forbes 30 Under 30 Energy List! At Ar…

Arolytics is honoured to be recognized as one of Canada's top 50 investable Cleantech ventures according to Foresight C…

Research the Arolytics founding team was involved in alongside others, while at St. Francis Xavier University, was rece…

On Tuesday, November 9th at 9 am MDT Darcy Partners hosted Arolytics for a discussion on software and modelling tools fo…

Arolytics was Gold sponsor & exhibitor at PTAC's 2021 Net Zero & Methane Emissions Reduction Conference on Nove…

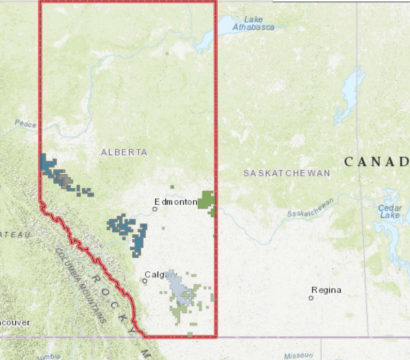

Attention Alberta based producers: Program details for the Alberta Methane Emissions Program (AMEP) were launched on Oct…

Arolytics is grateful to have been a part of the inaugural Houston Rice Alliance for Technology and Entrepreneurship Cl…

.jpeg?resize=410x0)

On Sept. 28th from 11 am to 12 pm MDT, Arolytics and Petroleum Technology Alliance Canada (PTAC) hosted an informative…

As stakeholders become increasingly interested in methane mitigation efforts from oil and gas companies, and as producer…

On Thursday, Aug 26 Arolytics joined the Alberta Machine Intelligence Institute and other panelists in an informative we…

.png?resize=410x0)

On August 23 and 24, Arolytics was a part of the virtual exhibit hall at US Environmental Protection Agency (EPA)'s Meth…

.png?resize=410x0)

[1] EPA Methane Detection Technology Workshop Host: EPA Date: August 23 and 24, 2021 Location: Virtual Description: Th…

U.S. President Biden this past week (June 30) signed a resolution into law that repealed President Trump-era methane pol…

Powerful methane-detecting satellites are helping to identify previously unseen methane emissions from oil and gas opera…

Calgary Venture funding continues to set record-highs according to Hockeystick's Calgary Tech Report. Arolytics was amo…

Arolytics' President & Co-founder, Liz O'Connell was the featured speaker for Innovate Canmore's ‘Women in Te…

Arolytics welcomes three summer interns, Harry, Dina & Marc. Introducing Harry: Harry Chen recently joined our tea…

Arolytics is thrilled to be accepted into the Houston-based Rice Alliance for Technology and Entrepreneurship Clean Ener…

Responsible Energy Development through Emissions Analytics Note: Arolytics and Seven Generations conducted this work pri…

Arolytics was involved in EnergyNow’s ‘Energy Innovation Virtual Conference and Company Showcase', which hi…

Why's It Critical? Despite the emergence of renewable energy sources, responsibly-produced oil and gas is expected to r…

A growing number of investors are assessing oil and gas companies on their environmental, social and governance (ESG) re…

Published by the Pembina Institute on May 28, 2021. The recent IEA net-zero report highlights the need to drastically c…

Arolytics has been selected to receive funding from Sustainable Development Technology Canada. Many thanks to our suppo…

The Alberta Energy Regulator (AER) has approved multiple alternative Fugitive Emissions Management Programs (alt-FEMPs)…

Arolytics has developed a cloud-based software that organizes and analyzes atmospheric emissions data from the energy se…

Arolytics, an emissions software and analytics company, announces theclose of an oversubscribed C$710,000 seed-finnancin…